03/12/2022

November 2022

Trust Machines

|

Convrse

|

DWallet Labs

|

Convrse

|

Plutoverse

November marked a tumultuous month for crypto markets with FTX & Alameda Research filing for bankruptcy. This follows a year where companies like Celsius, Voyager, and Vauld – all went down. What is the common thread? They were all Centralized Exchanges, with no relation to the core blockchain technology (in fact – they were quite opposite to the whole thesis of blockchain)

A brilliant example to emphasize the power of Blockchain is by comparing these CeFi exchanges with DeFi. This year, almost $150 Bn went out of DeFi and it happened seamlessly, decentralized, smart contract governed & without any disruption – which is the whole premise of Blockchain and Distributed Ledger Technology (DLT). Comparatively, a relatively smaller $6 Bn bank run brought FTX down!

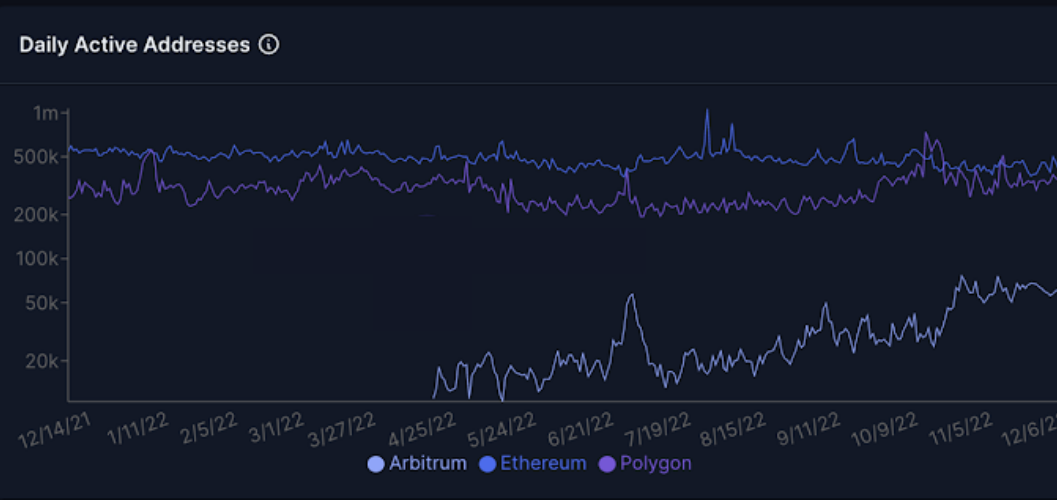

So, while FTX and other similar companies continue to have a downward spiral, Bitcoincontinues to mine block after block. Aave continues to settle financial arrangements. Chainlinkcontinues to feed real-world data into distributed networks. New protocols like Polygon & Arbitrum continue to see massive on-chain activity. Protocols will persist!

Source: Artemis-Number of Unique wallet addresses sending an on-chain transaction data in last 1 year

How is Tykhe and your investment doing?

At Tykhe, our thesis is to invest in companies solving for decentralization, digital assets, and supporting infrastructure. We cautiously stay away from companies that are merely leveraging the rise of decentralization to create non-sustainable businesses. Plus, we follow strong risk and compliance management at the time of making investments. Consequently, I am happy to inform you our portfolio companies, had ZERO exposure to FTX.

Not just that, while most of the Web3 funds globally have seen a dip in value (WSJ reports that a16z’s flagship crypto fund lost around 40% value this year), Tykhe is one of the few that has given positive returns. And speaking of a16z, while they made 9 investments in the third quarter of this year, we were just a tad behind – making 7 investments in total.

Let’s look at key highlights from some of the portfolio companies for the month of November

Besides, all our portfolio companies continue to track well. We shall keep you updated on key highlights in times to come.

Current Deal Flow

Buoyed by peak developer activity, we continue to evaluate some very interesting projects in the blockchain space. Our team is currently doing DD on 8 projects. Sneak Peek, we are close to finalizing investment in EDAO, where we aim to participate with one of our highest cheque sizes. The below infographic gives a good idea about EDAO. The deal is not yet finalized, but we thought it would be good to give you a view on what we love about them!

How do we feel about the times ahead?

Our research team has pulled out some key data points that keep us super stoked for the times to come. (special thanks to our friends at the BANKLESS community for some of this data)

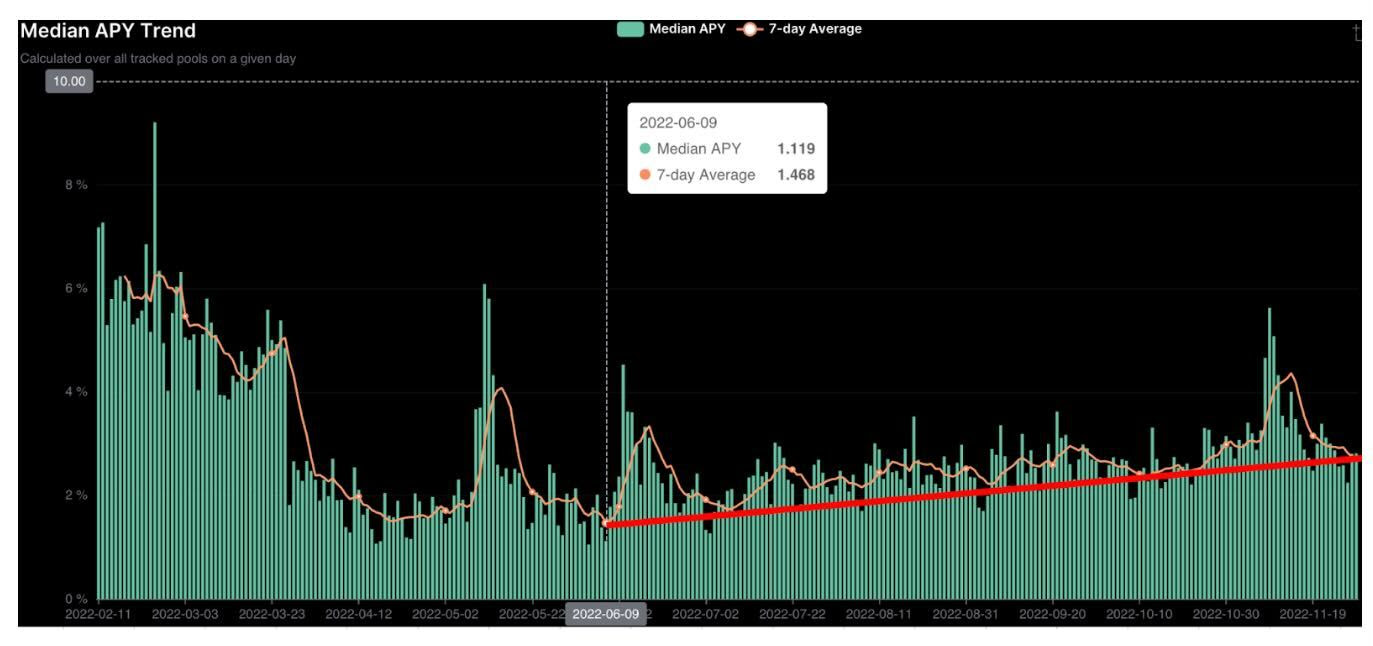

01. Rising Yields signals Institutional interest in Crypto.

Since bottoming on June 9, aggregate yields in DeFi have been up. Unlike trad-fi, where yields are primarily driven by macros like interest rate, crypto yields are generated from asset demand.

Higher DeFi yields are typically associated with higher crypto asset prices.

Why? Individuals and institutions primarily borrow to generate yields. Higher yields mean borrowers are willing to pay higher costs of capital, indicating better capitalization of borrowers in aggregate. Additionally, increasing yields to borrow signals that borrowers are moving to more risk-on investment approaches, which is bullish for asset classes, such as crypto.

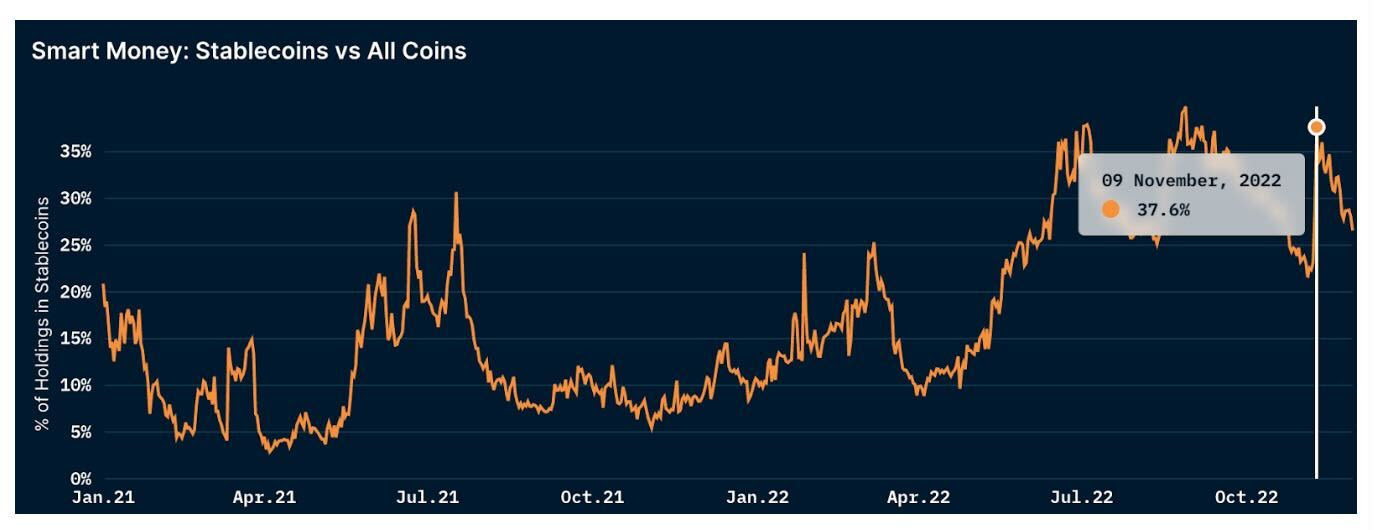

02. Smart Money Stablecoin Holding:

Investing in stablecoins allows crypto holders to mitigate risk and limit potential portfolio drawdowns, while keeping funds on-chain and enabling whales to easily redeploy capital.

While the stablecoin concentration of Smart Money portfolios has a long way to go until it revisits the sub 9% levels of April’2022, drawdowns in stablecoin allocation by smart money is necessary before a bottom can be fully formed. Currently, this stat is trending towards bullish territory.

Interesting times ahead!

As the curtains draw close to an eventful year, we would like to thank you for your belief and partnership. From the entire Tykhe family, we wish that 2023 holds success and good fortune for you and your loved ones!